How to Buy from Alibaba in Australia: An Aussie Guide

Introduction

For many entrepreneurs, figuring out How To Buy From Alibaba In Australia is the exciting first step toward building a successful brand. The global marketplace offers massive potential for Australian businesses to bypass middlemen and secure wholesale prices directly from manufacturers. Whether you are launching a new online store or scaling an existing operation, the ability to source affordable goods is a game-changer for your profit margins.

Table Of Content

- Introduction

- Preparation & Product Research

- Market Validation

- Verify Margins

- Understanding Australian Standards (Crucial)

- Finding & Vetting Suppliers

- Search Tactics

- The Vetting Checklist

- Initial Outreach

- The Legal & Financial Setup

- Business Structure & GST

- Contracts & Agreements

- Intellectual Property

- Sampling & Ordering

- The Golden Rule: Sample First

- Testing the Sample

- Negotiation

- Payment Methods

- Logistics & Shipping to Australia

- Shipping Methods

- Understanding Incoterms

- Freight Forwarders

- Customs, Taxes & Duties

- The $1,000 Threshold

- The Costs You Must Pay

- Customs Brokers

- Quality Control & Launch

- Pre-Shipment Inspection

- Upon Arrival

- Selling in Australia

- Conclusion

To understand the platform’s power, it helps to look at the bigger picture. Founded by Jack Ma, the Alibaba Group has revolutionized the e-commerce industry by connecting buyers with suppliers on a massive scale. It is important to distinguish this from AliExpress. While AliExpress is excellent for consumers buying single items, Alibaba is a powerhouse for B2B ecommerce. It is designed for those placing bulk orders to maximize cost savings and grow a sustainable Online Business.

However, simply finding a supplier is not the whole story. The “Australia Factor” adds a layer of complexity that importers cannot ignore. While clicking “buy” is easy, legally importing goods requires strict attention to detail. You must navigate regulations enforced by the Australian Border Force, ensure your items meet rigorous safety standards, and understand your tax obligations. Failing to prepare can lead to seized goods or unexpected costs that eat into your margins.

This article serves as your Ultimate Guide to navigating these waters. Our goal is to provide a safe, legal, and profitable roadmap to help you source products effectively. From vetting a trading company to understanding product sourcing logistics, we will cover everything you need to confidently bring goods from China to your doorstep in Australia.

Preparation & Product Research

Before engaging suppliers, laying the groundwork is essential. Success in importing relies heavily on thorough preparation to ensure there is actual demand for your idea.

Market Validation

It is risky to rely on intuition alone. Smart importers do not just guess; they research what Australians are actively looking for. By analyzing search results on platforms like Google Trends or browsing bestseller lists, you can identify which different products are gaining traction. If you plan to sell via Amazon FBA, reviewing current high-performers in your chosen product category can provide invaluable data. This research ensures you are investing in items with real potential for sales growth rather than sinking money into dead stock.

Verify Margins

Once a potential product is identified, the financial viability must be confirmed. It is not enough to just look at the factory price. You must calculate the total “landed cost”—the final sum of the manufacturing price, shipping costs, insurance, and Australian taxes. This includes estimating import duties and any applicable customs duty. Only by understanding these total expenses can you determine if you can offer competitive prices to your customers while still maintaining a healthy profit margin.

Understanding Australian Standards (Crucial)

This is often the biggest pitfall for new importers. Australian standards are notoriously strict—often more so than those in the US or EU. Whether you are importing electronics requiring SAA approval, toys, or cosmetics, compliance is non-negotiable. You must ensure the items meet all local safety standards and product safety regulations.

Before placing an order, request test reports and product certifications from the factory to prove compliance. It is vital to review the product specifications and product features in detail to ensure they align with Australian law. Remember, under Australian Consumer Law (ACL), if you import a product, you are legally deemed the “manufacturer.” This means the liability for due diligence falls squarely on you, not the overseas factory.

Finding & Vetting Suppliers

Finding the right partner is often the difference between a thriving business and a logistical nightmare. The goal here is to sift through the noise and find reliable partners who can meet your specific business needs.

Search Tactics

The process starts at the search bar. When entering keywords, it is important to be specific to filter the results effectively. A common challenge is distinguishing between a manufacturer and a trading company. While a manufacturer produces the goods, a trading company sources from various factories. Both have pros and cons, but knowing who you are dealing with is vital. To minimize risk, smart buyers always use the platform’s filters. Specifically, looking for verified suppliers is a non-negotiable step for many. These suppliers have undergone inspection by third-party institutions for validation purposes. Additionally, filtering for those who offer Alibaba’s Trade Assurance adds a layer of security, protecting your orders from payment to delivery.

The Vetting Checklist

Once a list of potential Alibaba suppliers is compiled, it is time to dig deeper. A shiny profile isn’t enough; you need evidence of reliability. Look for their “Gold Supplier” status and check how long they have been active—usually, three years or more is a good sign. Reviewing their track record and transaction history can reveal if they have experience selling to Western markets. A supplier who has successfully exported to Australia before will likely be more familiar with the local packaging and labeling requirements.

Responsiveness is another key indicator. If a supplier takes days to reply to a simple query via live chat or email, imagine the delays when a problem arises with an order. You want a partner who is professional and communicative.

Initial Outreach

When contacting an overseas supplier for the first time, professionalism is key. Avoid vague messages like “How much?” Instead, craft a clear inquiry that introduces your business and asks for specific details. It is crucial to ask about minimum order quantities (MOQs) and pricing tiers right away to see if they fit your budget.

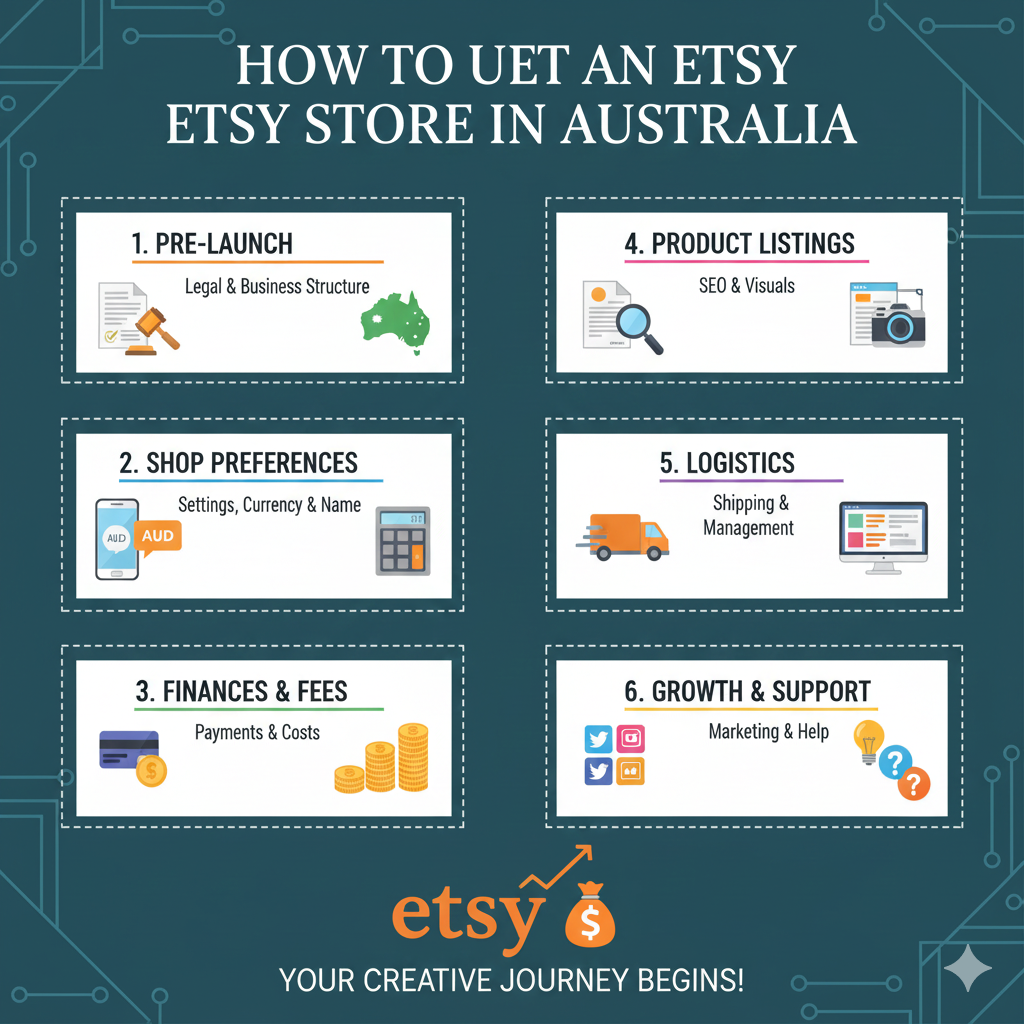

In this first message, also inquire about product quality and request detailed product descriptions or product details to ensure they match your expectations. While you might eventually move to email, keeping initial communications on the platform is safer. You might ask for a business Email Address or Phone Number for future correspondence, but establishing trust first is essential. Explicitly ask: ‘Have you exported this product to Australia before?’ Their answer will tell you a lot about their capability to handle your shipment smoothly. Once you have successfully sourced your items, you will need a marketplace to reach customers; if your products fit the unique or handmade niche, learning How To Set Up An Etsy Store In Australia is the perfect next step for launching your brand.

The Legal & Financial Setup

Once a potential supplier is found, the excitement often shifts to logistics, but skipping the legal and financial groundwork is a recipe for disaster. This phase ensures the business is legitimate, protected, and tax-efficient.

Business Structure & GST

For any serious importer, operating as a registered business is standard practice. While you can buy personal items without one, Australian businesses importing for resale almost always require an Australian Business Number (ABN). Having an ABN is crucial not just for legitimacy, but for formal importing procedures and claiming Goods and Services Tax (GST) credits.

Speaking of tax, GST registration is mandatory if your annual turnover exceeds $75,000. However, many importers choose to register voluntarily even before hitting that mark. Why? Because when you import goods, you are often required to pay GST at the border. Being registered allows you to claim these costs back as input tax credits, effectively smoothing out your cash flow.

Contracts & Agreements

One of the most common mistakes new buyers make is relying solely on informal communication. While Alibaba’s platform is great for connection, a simple chat history is rarely enough to protect you if a large order goes wrong. For significant purchases, relying on standard Terms & Conditions is risky.

To truly secure your investment, you should move beyond the app and establish a formal Supply Agreement. This document acts as the rulebook for your relationship. It should cover product specifications in extreme detail—down to the materials, colors, and dimensions—ensuring there is no room for interpretation. It must also outline clear quality warranties and dispute resolution processes. For high-value orders, it is often worth the investment to engage a specialist law firm to draft or review this agreement. This step clarifies expectations and signals to your suppliers that you view them as serious Business Partners, not just one-off vendors.

Intellectual Property

Before you print your brand name on thousands of units, you must ensure you have the right to do so. Infringing on existing trademarks can lead to your goods being seized by customs or facing legal action. A quick search on IP Australia’s database can save you from a legal nightmare.

Conversely, you must protect your assets. If you are building your own brand, you should strictly protect your Intellectual Property. The best way to secure your identity is to Register Your Trade Mark in Australia before the goods arrive. This legal shield prevents competitors from copying your hard work and gives you recourse if lookalikes start appearing on the market.

Sampling & Ordering

With the legalities sorted and a supplier chosen, it is time to move from theory to practice. However, rushing into a full commitment is dangerous. This phase is about minimizing risk through tangible verification and smart negotiation.

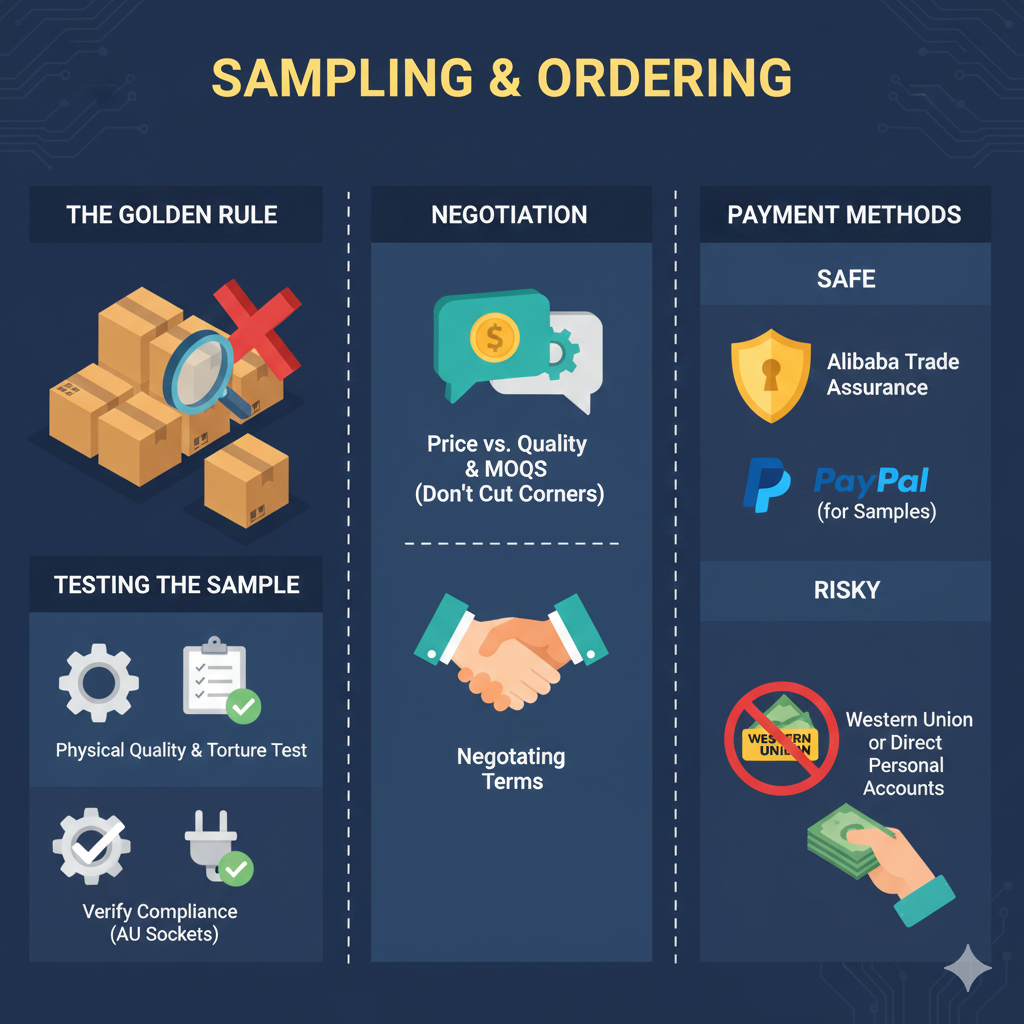

The Golden Rule: Sample First

There is one absolute rule in importing: never place bulk orders without seeing the product first. Photos can be edited, and descriptions can be misleading. A physical sample is the only way to verify that you are truly getting a quality product. Even if the supplier seems perfect, paying a premium for a sample shipment is a small price to protect your capital.

Testing the Sample

When the sample arrives, do not just look at it—put it to work. Perform a “torture test” by washing it, dropping it, or using it heavily to see how it holds up. You want to ensure you are selling top quality goods that will build a positive reputation for your brand.

Beyond durability, verify strict compliance with Australian infrastructure. For electronics, does the plug fit Australian sockets perfectly? For clothing, are the sizes accurate to the local market? If the sample fails here, it saves you the headache of a large order going to waste later.

Negotiation

Once the sample is approved, the conversation shifts to the final deal. Negotiation is an art. While you want a good price, pushing margins too hard often results in the factory cutting corners on materials. Aim for a fair balance where you get quality at a competitive rate.

This is also the time to discuss logistics, specifically the order quantity. If their standard requirement is too high, negotiate lower minimum order quantities for the initial run. Suppliers are often willing to accept larger orders in the future if you can prove your potential for long-term growth.

Payment Methods

When it is time to pay, choosing the right payment options is critical for your security. For the safest transaction, stick to Alibaba Trade Assurance. This system acts as an escrow service, holding your funds until you confirm the goods have been received and meet the agreed standards. It provides robust buyer protection, giving you a chance at getting your money back if the supplier fails to deliver.

Be wary of requests for a wire transfer or direct bank transfer to a personal account, especially for a first-time purchase. These methods offer little recourse if the supplier disappears. Stick to the platform’s secure channels to keep your investment safe.

Logistics & Shipping to Australia

Getting your goods out of China and into Australia is the physical bridge between your investment and your profit. Understanding the shipping process is vital, as logistics costs can significantly impact your bottom line.

Shipping Methods

Selecting the right mode of transport depends on your budget and urgency. There are three main shipping methods to consider:

- Express (Courier): For samples or very small urgent parcels, couriers like DHL or FedEx are ideal. They offer the fastest delivery times, often arriving within a few business days. While you might occasionally see ” free shipping ” offers for tiny items, this is rare for commercial quantities.

- Air Freight: When speed is critical but the shipment is too heavy for a courier, Air Freight is the solution. It is faster than sea transport but significantly more expensive. It is best suited for high-value, low-weight items where getting to market quickly justifies the cost.

- Sea Freight: For the vast majority of importers, sea freight is the standard for bulk orders. It offers the most significant cost savings but comes with longer shipping times.

- LCL (Less than Container Load): If you don’t have enough stock to fill a container, you share space with other shippers.

- FCL (Full Container Load): You rent the entire container. This is often safer and faster than LCL as your goods are not handled as much.

Understanding Incoterms

Incoterms determine who pays for what during international shipping.

- EXW (Ex Works): You are responsible for everything from the factory door in China. This gives you maximum control but requires maximum work.

- FOB (Free on Board): The supplier pays to get the goods to the port and clears export customs. You take over from there. This is the industry standard and highly recommended.

- DDP (Delivered Duty Paid): The supplier handles everything to your door. While convenient, it often hides inflated costs, and you have less control over the Logistics Service used.

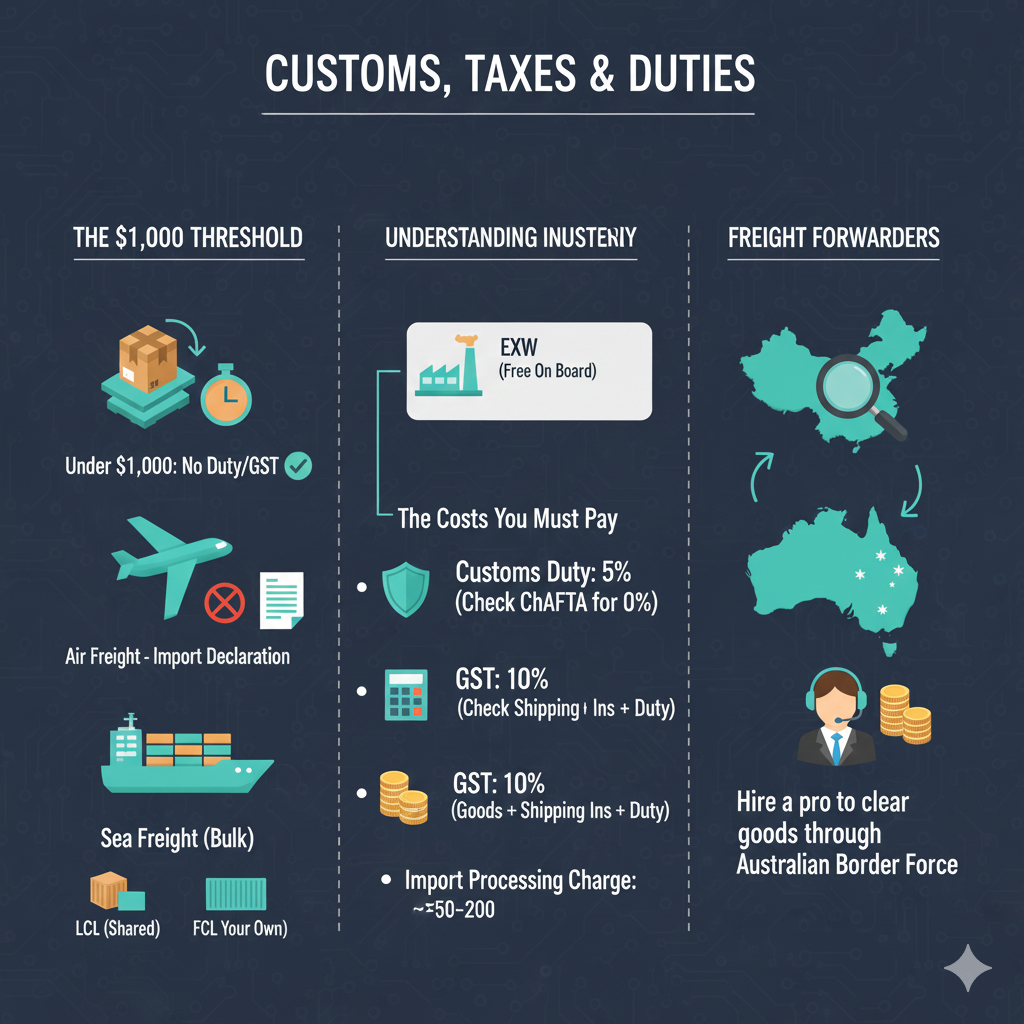

Freight Forwarders

While Alibaba Shipping services are available, experienced importers often prefer to engage a dedicated freight forwarder to ensure a smoother shopping experience. A forwarder based in Australia understands local regulations better than an agent in Hong Kong or the United States. They can help you compare shipping quotes, manage customs clearance, and coordinate the complex journey from the Chinese port to your warehouse.

Using a local forwarder allows you to ship products with confidence, ensuring they match their product listings, knowing there is an expert handling the ‘China to Australia’ leg. Interestingly, shipping from China to Australia is often more straightforward and faster than shipping to the United Kingdom or New York, provided you have the right partner steering the ship.

Customs, Taxes & Duties

While finding a product is exciting, getting it across the border is where the real work begins. Understanding the costs involved is critical to ensuring your profit margins remain intact. This phase covers the essential financial obligations you will face when goods arrive in Australia.

The $1,000 Threshold

For many small businesses and startups, the $1,000 threshold is the magic number. If the total value of your shipment is under $1,000 AUD, you generally do not have to pay duty or GST at the border, although you are technically still liable for the taxes. However, once your shipment value exceeds $1,000 AUD, the rules change significantly. You are legally required to lodge an Import Declaration, and this triggers a formal customs clearance process.

The Costs You Must Pay

When your goods exceed the threshold, you need to budget for three main costs. First is the customs duty. For many items, this is calculated at 5% of the goods’ value. However, thanks to the China-Australia Free Trade Agreement (ChAFTA), many products can be imported with 0% duty if you have the correct documentation from your supplier.

Second is the Goods and Services Tax (GST). It is important to note that GST is not just charged on the cost of the item. It is calculated on the “Value of Taxable Importation,” which includes the cost of goods, shipping costs, insurance, and the duty itself. This compounding effect can surprise new importers. Finally, there is the Import Processing Charge, a government fee that typically ranges between $50 and $200, depending on the mode of transport and the value of the consignment.

Customs Brokers

Navigating these calculations and lodging declarations can be complex. Errors can lead to delays or fines. This is why many businesses choose to hire a licensed customs broker. A broker handles the complexities of import duties and ensures all paperwork is accurate, saving you time and stress.

For a detailed breakdown of how these costs are calculated, you can refer to the Australian Border Force guide on importing goods.

Quality Control & Launch

The final hurdle before your products hit the market is ensuring they match the standards you paid for. This phase is about protecting your reputation and ensuring your inventory is ready for sale.

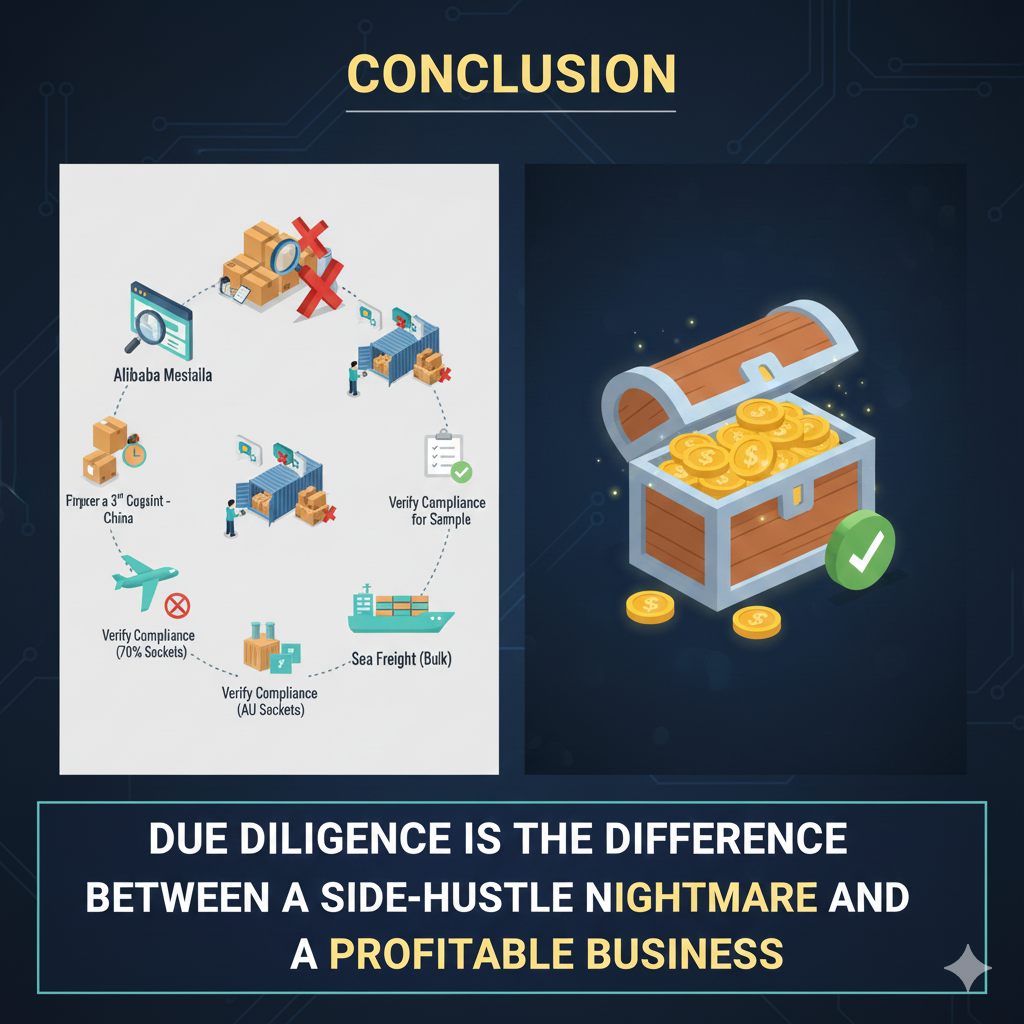

Pre-Shipment Inspection

Never pay the final balance—usually 70% of the cost—until you are certain the goods are perfect. Once the money leaves your account, your leverage disappears. Smart importers hire a third-party inspection agent in China to visit the factory. This step is vital for due diligence. They can open boxes, test products, and verify that the items match your Supply Agreement.

For sensitive categories like skincare or electronics, this is non-negotiable. A defect rate that is acceptable to a factory might destroy your brand’s reputation in Australia. If the report comes back clean, you can release the payment with confidence.

Upon Arrival

When the shipment lands, your job isn’t done. Whether the goods are delivered to your warehouse or sent directly to Amazon FBA centers, you must check them immediately. Look for water damage, crushed boxes, or missing units. If there are issues, document them with photos instantly to claim insurance or discuss with your supplier.

Effective stock management is also key. If you are managing your own online store, ensure your inventory system is updated to reflect the new stock levels so you don’t oversell.

Selling in Australia

Launching your product is where the success stories begin. However, as you start selling, remember your obligations under Australian Consumer Law (ACL). You cannot simply blame the Chinese factory if a customer receives a faulty item. As the importer, you are responsible. You must offer refunds or replacements for major failures. Building a brand known for reliability will lead to long-term sales growth and set you apart from competitors who disappear when things go wrong.

Conclusion

Mastering How To Buy From Alibaba In Australia is a journey that transforms a simple concept into a tangible reality. We have covered the essential steps of this process, starting from the initial research to validate your idea, to the critical phase of vetting verified suppliers to ensure they meet Australian businesses‘ standards. You now understand the importance of securing a Supply Agreement, navigating payment methods like Alibaba Trade Assurance, and selecting the right shipping methods to get your goods home safely.

Alibaba is a massive ecosystem connecting millions of Alibaba sellers to buyers globally. It is a giant listed on the New York Stock Exchange, offering everything from cloud computing and online Travel Agencies to trade financing. But for you, it is simply the bridge to the world’s factory. By following this guide—validating your market, consulting the Support Help center, reviewing the Service Privacy Policy, and managing logistics—you are building a foundation for success.